OpenEnterprise.AI and Salesforce partnership will revolutionize Commercial Lines Underwriting in 2024

OpenEnterprise.AI a leader in Industry AI and digital engagement applications for the Insurance and healthcare industries ,is announced the launch of OpenEnterprise Insurance for Salesforce on the Salesforce AppExchange to enable Insurance organizations to leverage the power of Industry specific pre trained LLM’s. OpenEnterprise’s Insurance for Salesforce delivers purpose built foundation Industry AI Models and apps to advance decision making ability by humans, scaling up the most valuable decision makers in enterprises, leading to exponential returns.

The solution is available to customers using Salesforce Financial Services Cloud for Insurance, It uses Salesforce Data Cloud for submission intake and extraction and OpenEnterprise.AI’s purpose built AI models, including Industry Language Models that are managed and fine tuned as part of the solution offering.

The strength of the two platforms enables Insurance carriers,Brokers and MGA’s to build the next generation Intelligent Intake solutions that leverages Submission AI and eradicate manual processing and data entry, freeing up underwriters to write the most profitable business fast! By automating submission intake, Salesforce and OpenEnterprise.AI are setting a new standard for efficiency with next generation Industry AI solutions. OpenEnterprise.AI plans to integrate with Einstein Co-Pilot with winter release.

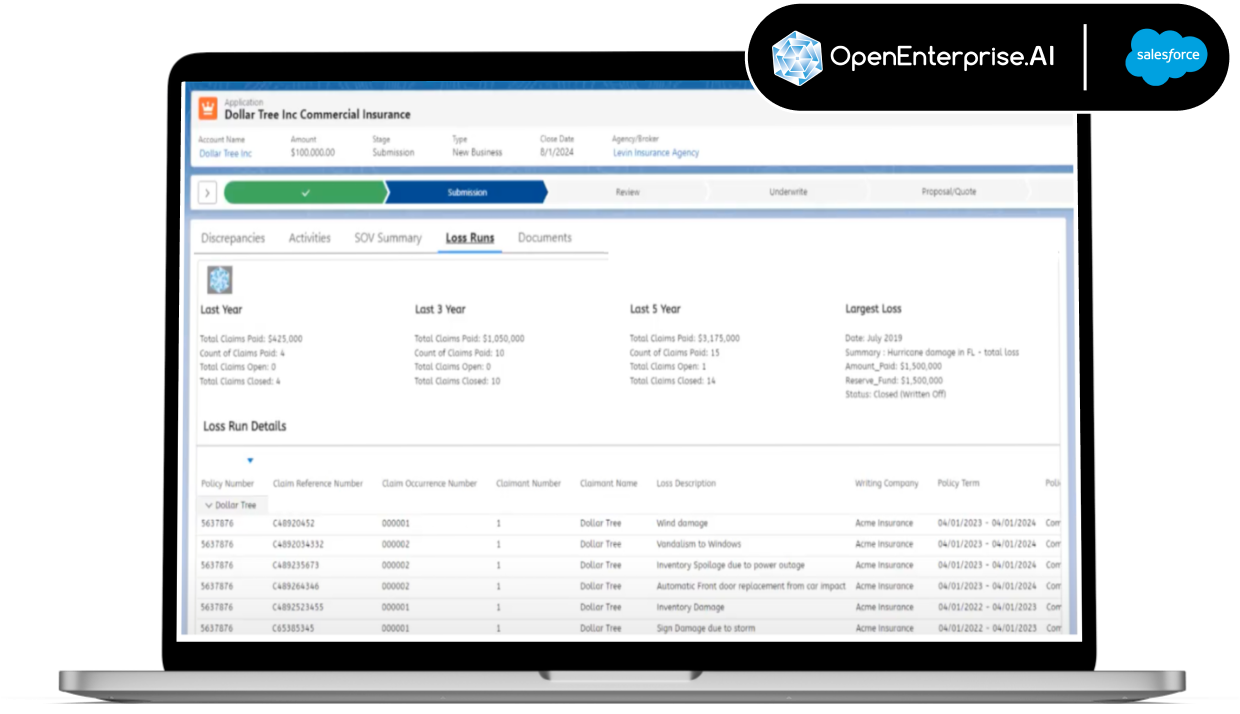

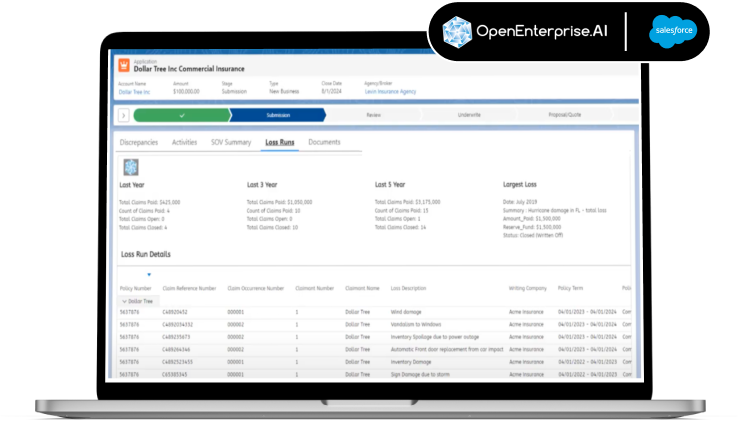

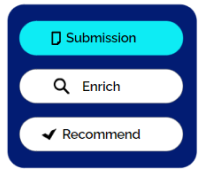

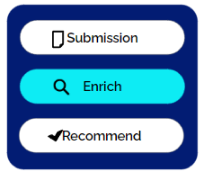

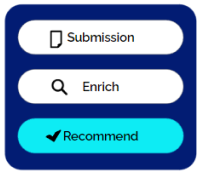

Solution Demonstration

Intelligent Intake for submission.

Streamline Application Enrichment

Augment Underwriter Recommendations

Laura Boyle

Underwriter workbench Accelerated

Industry Model Library

A library of foundation Insurance, P&C and application specific AI models that are purpose built and trained on Commercial Property and Casualty processes. These models, leveraged in the P&C applications are fine tuned on your data.

Insurance Foundation Models

Accelerated deployment leveraging pre-trained models for decisioning in your business such as Statement of Values, Image Analysis and Location Analysis.

Bundled With Applications

Bundling models together with more traditional software components in an application provides improved business value and allows for extension of this intelligence across the enterprise.

Improved Trust and Confidence

Models trained at the discrete level of Insurance, further into P&C processes, and final tuning on your data. Higher accuracy in results, and greater efficiency and performance, all leading to improved user trust and confidence in the end results

Intelligent Underwriting Workbench Applications

Discover the intelligence that sits in your data today to deliver greater results and value across your business.

Intelligent Intake

OpenEnterprise integrates standard and supplemental application, email attachments and documents into the Intake Process across all carriers; digitizing and summarizing all information to drive higher STP rates.

Multi-market Underwriting

OpenEnterprise digitizes Guidelines and further trains all relevant application models on these guidelines. All Images and supporting documents can be analyzed against guidelines to surface key risks, generate follow up recommendations,; ; reducing manual analysis and increasing Underwriter throughput.

Program Optimization

OpenEnterprise plans to review current Book of Business, Pipeline, Loss/Win history by Class of Service & Carrier as well as Trends; generating recommended changes for specific carriers for each Class of Service. This empowers MGA’s to be more adaptive to their market by incenting carriers

Why OpenEnterprise.AI for Salesforce Commercial Property & Casualty

Enable Agents, Brokers, MGA’s and Carriers to -

- Redesign the underwriting value chain with data insights and trusted AI across their channels.

Delivered Directly through Salesforce Underwriting Workbench

Tackle the biggest challenge first by focusing on Intelligent Intake. OpenEnterprise.AI extracts key information from prospect applications, images, SOVs, loss runs and guidelines. This key information is summarized for your Underwriters to focus on accelerated decisioning and driving incremental business.

Integrate Seamlessly with Salesforce Insurance Solutions

OpenEnterprise.AI is continuously expanding the Industry Model Library, and AI augmented applications across the Salesforce Insurance Solution. Information can be consumed in the Business Rules Engine, Insurance Quote/Rate/Apply and Claims Management.

A New Success Model for AI Applications

What’s included in your subscription is the following:

- Secure Infrastructure

- Insurance Data Lake on Salesforce Data Cloud

- Model Training and Utilization

- Model Enhancements

- Alignment to MLOps

Salesforce Data Cloud

Intelligent Intake and Efficient Data Processing

Efficient data processing across large volumes of structured and unstructured data enable you to use OpenEnterprise’s AI models for accurate & fast underwriting decisions.

Underwriting Decisions

An augmented AI framework that blends human judgement with data intelligence and insights provided via underwriter workbench for fast and accurate underwriting decisions

Book of Business

Move from an application-centric approach to generating a greater book of business by embedding Underwriter Intelligence across business processes and workflows.

Trusted AI

Built for Einstein 1 Studio Model Builder

Einstein 1 Studio provides the flexibility to connect directly to OpenEnterprise Industry AI models.

Administrators can connect Openenterprise directly into their salesforce instance with no code.

Focus on business outcome

Surfacing the right data at right time for Underwriters to make a final decision based on Industry AI augmented data .

100% accuracy rate

Guarantee that outcomes are accurate, relevant, and grounded with your company’s data without requiring expensive model training or having to codify everything into rigid business rules.

Pricing

How to get started

Starter Pack $30K

Includes two foundational models for Summarization and Digitization. Begin to see the value of your data by bringing your unstructured data into the Data Cloud.

Applications $120K/Yr/Org

Capture maximum business value with three Property & Casualty applications, available directly from AppExchange.

Contact us

Attend the Introduction to Intelligent Intake every Wednesday at 11am PT

Or email us at Hello@openenterprise.AI

Thank you..!!!

Your form has been submitted successfully.

CRMIT Solutions Partners with OpenEnterprise.AI to Revolutionize Generative AI for Healthcare Payers